India’s economy has seen significant growth over the past few decades, and at the core of this development is the intricate relationship between GDP (Gross Domestic Product) and inflation. But how exactly does GDP affect inflation in India, and why is it important for policymakers, economists, and the average Indian citizen to understand this dynamic?

In this blog, we’ll explore the effect of GDP on inflation in India, shedding light on how these two crucial economic indicators interact. We’ll dive into historical data, government policies, and external factors that influence this relationship, helping you gain a deeper understanding of India’s economic future.

Table of Contents

The Link between GDP and Inflation: An Overview

What Is GDP and Why It Matters for Inflation?

Gross Domestic Product (GDP) is the total value of goods and services produced within a country over a specific period. It is often seen as a primary indicator of a country’s economic health. When GDP rises, it generally signals that the economy is growing—more goods and services are being produced, more jobs are being created, and consumer spending is likely increasing.

But as demand for goods and services increases with GDP growth, inflation can follow. This is because higher demand often leads to higher prices. In simple terms, when people have more money to spend, they tend to spend it, which can push prices up, leading to demand-pull inflation.

Inflation in India: A Persistent Economic Concern

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. In India, inflation has been a constant challenge, driven by factors such as rising fuel prices, increasing wages, and external economic shocks. Over the years, inflation has influenced the cost of living, making it a key issue for policymakers.

Historically, India has seen periods of high inflation during times of rapid GDP growth. For instance, in the early 2000s, the Indian economy expanded rapidly, but inflationary pressures, particularly in food and fuel prices, caused significant concern.

You may Read Also: Finance Minister Reviews Capex Plan of Housing and Urban Affairs Ministry

How Does GDP Affect Inflation in India?

GDP Growth: A Double-Edged Sword for Inflation

When GDP growth occurs, it is generally a sign of a healthy economy, but it can also lead to inflation if growth outpaces the economy’s ability to meet demand. This is known as demand-pull inflation, where too much money chases too few goods.

In India, this has been seen during periods of rapid economic expansion, such as after liberalization in the 1990s and during the tech boom of the early 2000s. During these times, while GDP grew rapidly, inflation also surged, particularly in essential sectors like food, housing, and fuel.

The Phillips Curve and India’s Economy

A key economic theory that helps explain the relationship between inflation and GDP is the Phillips Curve. The Phillips Curve posits an inverse relationship between unemployment and inflation—when unemployment is low, inflation tends to be higher, and vice versa. In India’s context, as the economy grows and more jobs are created, inflationary pressures increase as more people have money to spend, pushing prices higher.

However, the relationship between GDP growth and inflation is not always straightforward. Other factors, such as supply chain issues, external shocks like oil price fluctuations, and government policies, also play a role.

The Role of Inflation Expectations in GDP Growth

Inflation is often influenced by what people expect to happen in the future. When consumers and businesses expect inflation to rise, they tend to adjust their behavior accordingly. Consumers may increase their spending now to avoid higher prices later, while businesses may raise their prices in anticipation of increased costs.

In India, inflation expectations are often driven by the cost of essentials like food, fuel, and housing. These sectors are particularly sensitive to changes in GDP and inflation, and any fluctuations can have a ripple effect across the economy.

You May Read Also: What is a Fed Rate Cut? Understanding its Impact on the Economy

India’s Economic Policies: Managing GDP and Inflation Together

To manage the balance between GDP growth and inflation, the Indian government and the Reserve Bank of India (RBI) have implemented various policies over the years.

One of the primary tools used to control inflation is the interest rate. By raising interest rates, the RBI can curb consumer spending and reduce demand, which helps to lower inflation. Conversely, during periods of low GDP growth, the RBI may lower interest rates to stimulate spending and boost economic activity.

For example, during the 2008 global financial crisis, the Indian government introduced stimulus measures to boost GDP growth. However, this led to a rise in inflation, particularly in the food and fuel sectors. To combat this, the RBI raised interest rates in subsequent years to control inflation, demonstrating the delicate balance between promoting growth and managing inflation.

External Factors Affecting GDP and Inflation in India

Global Oil Prices and Their Impact on Inflation

India is one of the largest importers of oil, and global oil prices play a significant role in driving inflation. When oil prices rise, transportation and production costs increase, which are then passed on to consumers in the form of higher prices for goods and services. This can lead to higher inflation, even if GDP growth remains steady.

In recent years, fluctuations in global oil prices have had a direct impact on inflation in India, particularly in sectors like transportation, agriculture, and manufacturing.

Supply Chain Disruptions and Their Ripple Effect on GDP and Inflation

Another critical factor influencing GDP and inflation in India is supply chain disruptions. Whether caused by global events like the COVID-19 pandemic or domestic issues such as labor shortages, these disruptions can slow GDP growth and simultaneously drive up prices, leading to cost-push inflation.

For example, during the pandemic, supply chain disruptions led to shortages of essential goods, driving up prices and contributing to inflation, even as GDP growth slowed.

You May Read Also: Top 10 New Technology Trends in 2024: A Comprehensive Guide

The Long-Term Relationship between GDP and Inflation

Does Rising GDP Always Lead to Higher Inflation?

While GDP growth and inflation are often linked, it is not always the case that rising GDP will lead to higher inflation. In many cases, particularly in developing economies like India, GDP can grow without substantial inflation if there are productivity improvements, technological advancements, and sound economic policies in place.

For example, during periods of technological innovation, such as the adoption of digital payment systems and automation in India, the economy can grow while keeping inflation relatively low. However, if GDP growth is too rapid or driven by excessive demand, inflationary pressures are likely to increase.

India’s Experience: A Look at Past Data

India’s economic history provides several examples of the relationship between GDP and inflation. During the early 2000s, as India’s economy grew rapidly, inflation also surged, particularly in the food and fuel sectors. However, in more recent years, the government and RBI have implemented policies aimed at managing inflation while sustaining GDP growth.

Future Predictions: What Lies Ahead for India?

GDP Growth Forecast for India

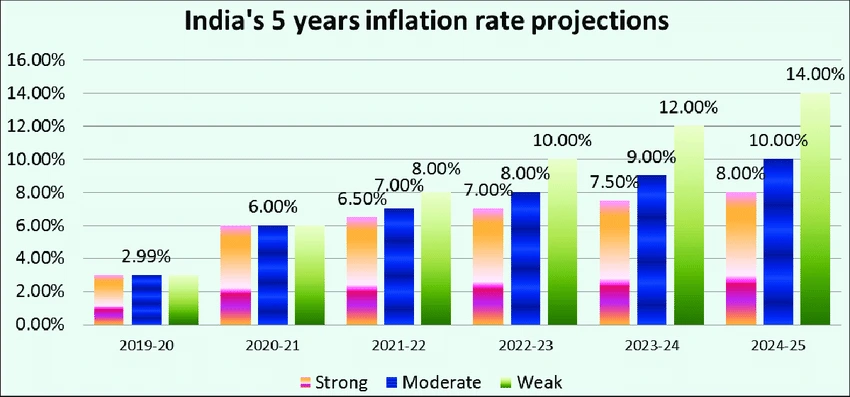

India’s economy is expected to continue growing in the coming years, with experts predicting a return to robust GDP growth following the economic slowdown caused by the pandemic. However, as GDP growth accelerates, it is important to monitor inflationary pressures to ensure that the benefits of growth are not eroded by rising prices.

Will Inflation Be Under Control?

Inflation is likely to remain a key concern for policymakers in India. The Reserve Bank of India has set an inflation target of 4%, with a tolerance band of +/- 2%. As GDP growth continues, the RBI will need to carefully balance its policies to maintain inflation within this target range, ensuring that the economy can grow without excessive price increases.

You may Read Also: Top 10 Best Residential Projects on Noida Expressway

Conclusion: Navigating the GDP-Inflation Balance in India

The relationship between GDP and inflation is a complex one, with multiple factors influencing both. For India, understanding this relationship is crucial for maintaining economic stability and ensuring sustainable growth.

By implementing sound policies and keeping a close eye on inflation expectations, the Indian government and RBI can continue to promote GDP growth while keeping inflation under control.

FAQs Related to effect of GDP on inflation in India

What is a GDP vs. Inflation Chart?

A GDP vs. Inflation chart visually compares a country’s economic growth (GDP) with the rate of inflation over time. It helps illustrate the relationship between these two indicators, showing periods where high GDP growth may correlate with rising inflation or, conversely, where inflation remains stable despite growth.

What is the relationship between inflation and economic growth?

Economic growth, measured by GDP, and inflation are often interconnected. In periods of robust economic growth, increased demand for goods and services can lead to higher prices, causing demand-pull inflation. However, if managed well, moderate inflation can coexist with growth without harming purchasing power.

Effect of GDP on inflation in India in 2021?

In 2021, as India recovered from the pandemic, GDP growth rebounded, but inflation remained a concern, largely due to supply chain disruptions and rising fuel prices. Higher economic activity increased demand, contributing to moderate inflationary pressures.

What is the relation between GDP and inflation in India?

In India, the relationship between GDP and inflation is often complex. Strong GDP growth can lead to inflation if it drives increased demand for goods and services without a corresponding rise in supply. However, sound fiscal and monetary policies can help manage inflation even during times of growth.

How does GDP affect inflation?

GDP growth can cause inflation when an economy expands too quickly. As people earn more and spend more, demand rises, leading to higher prices. This effect is most noticeable when supply cannot keep up with the increased demand, resulting in demand-pull inflation.

What are the effects of GDP in India?

Rising GDP in India typically leads to higher incomes, job creation, and improved living standards. However, rapid growth can also lead to inflation, widening income inequality, and environmental stress if not managed carefully.

What is the relationship between GDP and CPI?

GDP measures the total economic output, while the Consumer Price Index (CPI) tracks changes in the price level of a market basket of consumer goods and services. A growing GDP often leads to rising CPI due to increased demand, which can push up prices and contribute to inflation.