In the vast and ever-evolving world of forex trading, one term that consistently pops up for beginners is “micro lot.” Understanding this concept is crucial for anyone starting out, particularly those with smaller accounts or cautious risk appetites. In this detailed guide, we’ll break down what a micro lot is, its role in the forex market, and how you can benefit from it as a trader.

Table of Contents

Introduction to Micro Lot in Forex Trading

What is a Micro Lot?

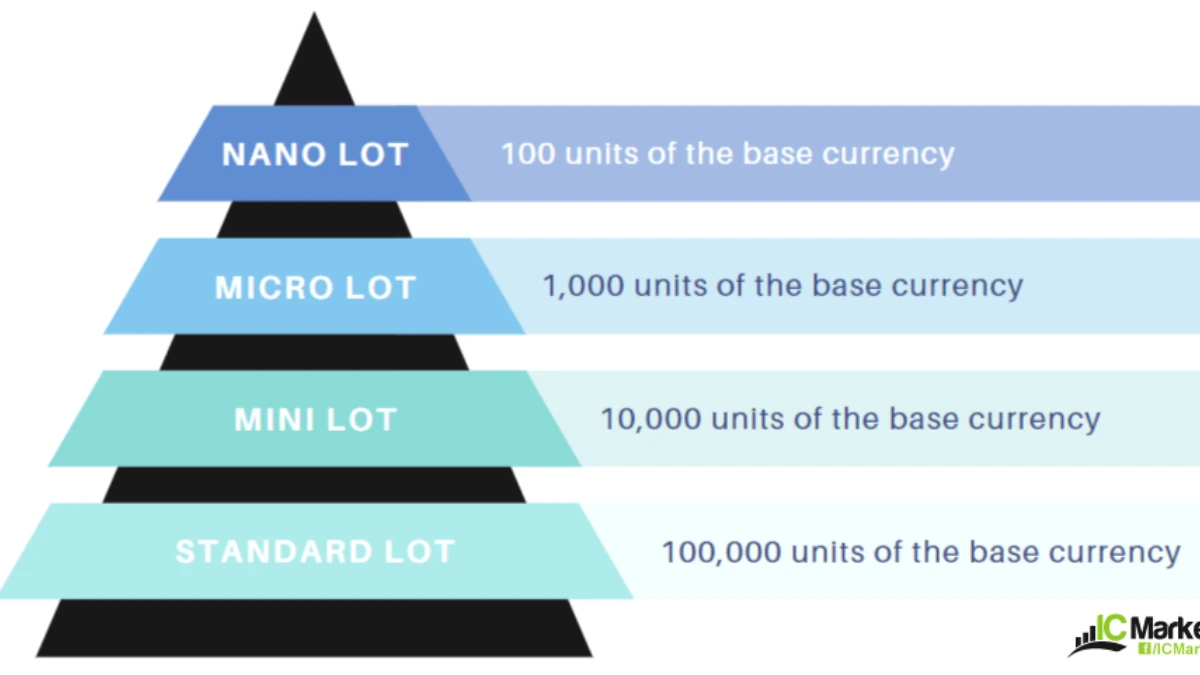

A micro lot in forex trading is the smallest standard unit of currency that a trader can trade. It represents 1,000 units of the base currency, as opposed to a mini lot (10,000 units) or a standard lot (100,000 units). Micro lots are perfect for traders with smaller accounts or those who want to minimize their risk exposure.

For example, if you’re trading the EUR/USD currency pair and you purchase a micro lot, you’re trading 1,000 euros. This smaller trade size helps you control risk and minimize losses, particularly in a volatile market like forex.

Why Micro Lots Matter for Beginners in Forex

Forex trading requires understanding the complexities of leverage, margins, and risk management. Micro lots offer a way for new traders to engage in the market with a minimal financial commitment. Since each pip (percentage in point) represents a small value (typically $0.10 in most major currency pairs), beginners can better manage their trades without the stress of large market swings.

Understanding Forex Trading Lot Sizes

In forex, a lot refers to the standardized quantity of the currency being traded. Understanding the different types of lot sizes is important to tailor your trading strategy according to your risk tolerance and capital.

Overview of Mini Lot and Standard Lot Sizes

- Micro Lot: 1,000 units of the base currency, where each pip is valued at $0.10.

- Mini Lot: 10,000 units of the base currency, where each pip is valued at $1.

- Standard Lot: 100,000 units, where each pip movement is valued at $10.

Each lot size comes with its own risk and reward. For instance, while standard lots provide the opportunity for significant profit, they also pose greater risk for traders with smaller accounts.

Benefits of Using Different Lot Sizes in Forex Trading

Micro lots allow for better risk management and smaller financial exposure, which is particularly beneficial for beginners. On the other hand, mini and standard lots are suited for traders with larger accounts and greater risk tolerance.

Advantages and Disadvantages of Trading with Micro Lots

Advantages of Micro Lot Trading

Lower Risk for Small Traders

The biggest advantage of micro lot trading is the lower risk. With each pip valued at $0.10, even small market fluctuations don’t cause significant losses. This gives novice traders the opportunity to experiment with trading strategies without the fear of significant losses.

Risk Management for Beginners

Micro lots are often recommended for those who are just starting their forex journey. You can trade smaller amounts, apply strict risk management strategies, and limit potential losses, making it the perfect setup for anyone still learning the ropes.

Perfect for Testing New Strategies

For experienced traders, micro lots offer an excellent way to test out new strategies or trading systems without committing large capital. Whether it’s scalping, swing trading, or even position trading, you can test these approaches in a real-time market environment with minimal risk.

Disadvantages of Micro Lot Trading

Limited Profit Potential

The downside of trading micro lots is the limited profit potential. Each pip movement results in a small monetary change, so traders looking for substantial gains will need to trade larger volumes or move up to mini or standard lots.

Higher Transaction Costs Over Time

While micro lots reduce risk, they can also come with higher cumulative transaction costs. With more frequent trades needed to achieve meaningful profits, these costs can add up over time, eating into your bottom line.

How to Start Trading Forex with Micro Lots

Choosing the Right Forex Broker for Micro Lot Trading

Not all forex brokers offer micro lot trading, so it’s important to select one that does. Consider factors such as the broker’s transaction fees, leverage options, and currency pairs offered when making your choice. Popular brokers like IC Markets, Oanda, and Pepperstone provide excellent platforms for micro lot trading.

Opening a Micro Lot Account

Opening a micro lot account is relatively simple. Most brokers offer demo accounts, where you can practice without risking actual money, or micro accounts with a low minimum deposit to get started.

Calculating Pip Value in Micro Lots

When trading micro lots, it’s essential to understand the pip value. A pip is typically the smallest price move that can occur in a currency pair. For a micro lot, each pip movement is worth $0.10. This makes it easier to calculate your potential profit or loss in each trade.

Micro Lot Trading Strategies for Beginners

One of the best strategies for new traders is trend following, where you follow the general direction of the market to make your trades. Another popular strategy is range trading, where traders identify key levels of support and resistance to buy low and sell high within a confined range.

Micro Lot vs. Mini Lot: What’s the Difference?

H4Detailed Comparison

While both micro and mini lots are smaller than the standard lot, they serve different purposes. Mini lots offer a higher potential for profit but also come with more risk, as each pip is worth $1 compared to $0.10 for a micro lot.

When to Use Micro Lots vs. Mini Lots in Forex Trading

Micro lots are best for traders with small capital or those who wish to minimize risk. Mini lots are more suited for traders who have mastered risk management and are ready to take on larger trade sizes.

Common Mistakes to Avoid When Trading with Micro Lots

Over-leveraging Your Account

Even when trading micro lots, over-leveraging can lead to significant losses. Ensure that you’re using appropriate leverage based on your account size and trading strategy.

Misunderstanding Pip Value

Many beginner traders don’t fully understand the pip value in micro lots, leading to incorrect risk management. Always calculate the potential impact of each pip on your trade before placing an order.

Ignoring Transaction Costs

Even though micro lots reduce your overall risk, transaction costs can add up. Be mindful of spread, commission, and other charges, as frequent trading can erode your profits over time.

Overtrading with Micro Lots

It’s tempting to place many trades due to the low risk involved in micro lot trading, but overtrading can lead to emotional decisions and exhaustion. Stick to a clear trading plan and avoid unnecessary trades.

Conclusion: Is Micro Lot Trading Right for You?

Key Takeaways for New Traders

For beginners and those with limited capital, trading with micro lots is an excellent way to learn the forex market without significant financial risk. While profits are limited, micro lots provide a controlled environment to practice, experiment, and grow as a trader.

Balancing Risk and Reward in Forex Trading with Micro Lots

Ultimately, micro lots offer a balanced risk-reward ratio for new traders, allowing them to gain experience while safeguarding their investments. As your skills and confidence grow, you can gradually increase your trade sizes and consider mini or standard lots for higher profitability.

1. How much is 0.01 micro lot?

In Forex trading, 0.01 micro lot is equivalent to 1,000 units of the base currency. For example, if you’re trading EUR/USD, 0.01 micro lot means you’re trading €1,000.

2. How much is 10 micro lots?

10 micro lots are equivalent to 10,000 units of the base currency. This is the same as 0.1 standard lot in Forex trading.

3. How much is 1 mini lot in Forex?

1 mini lot in Forex is equivalent to 10,000 units of the base currency. It’s one-tenth of a standard lot.

4. 0.01 माइक्रो लॉट कितना है?

0.01 माइक्रो लॉट का मतलब 1,000 यूनिट्स बेस करेंसी का होता है। उदाहरण के लिए, अगर आप EUR/USD ट्रेड कर रहे हैं, तो इसका मतलब आप €1,000 की ट्रेडिंग कर रहे हैं।

1. What is the best lot size for $200?

For a $200 account, it’s generally recommended to trade with 0.01 micro lots. This allows you to manage risk effectively and avoid significant losses. A micro lot size (0.01 lot) gives you more flexibility to withstand market fluctuations without risking too much of your capital.

2. What lot size is good for $100 in Forex?

With a $100 account, 0.01 micro lots are also advisable. This small lot size helps you limit your risk while still allowing you to participate in the market. Trading with larger lot sizes can quickly deplete your account, especially in volatile markets.